Budgeting 101: Using a budget spreadsheet

With a struggling economy, high unemployment, and mounting debt, many people are struggling to make ends meet. More than ever, budgeting is becoming popular as people seek to reign in spending and pay off their debts.

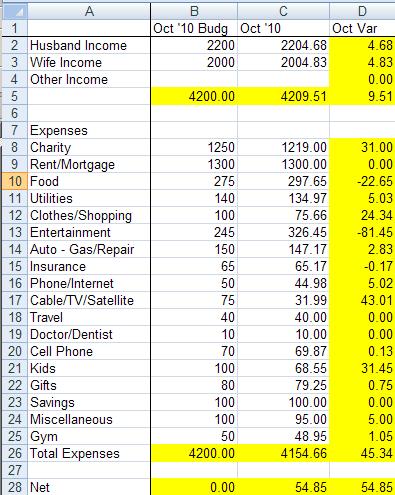

While tips on getting out of debt go far beyond this budgeting example, there are simple steps you can take to track your spending and expenses. You don’t need budget software like Quicken to start learning how to budget. Here is a simple budget spreadsheet that I created for my budget. So let’s learn how to budget.

Simple budget

Enter budgeted amounts

- Column A is for your spending categories. Column B is for your actual expenses and column C is your variance.

- Do not key any amounts into cells that are yellow. These are calculated fields with formulas.

- At the beginning of each month, key in your budgeted income amounts for your household. If your spouse, roommate, or other income earners are included in the budget, create a separate line for each and enter the amount of their monthly take home pay in column B2 and B3 (or more lines if needed). If you have extra sources of income which aren’t part of your pay, enter them in B4.

- Once your income is entered, enter your estimated expenditures in column B for each category. Some of these will be fixed, like rent or mortgage, while some will vary. If you’ve never tracked your expenses before, key in your best estimated guess.

- The Net total (B28) should be zero or close to zero after your budgeted income and expenses are entered. If you have money left over, put the remaining amount into the Savings column.

Enter actual expenses

- You can track your monthly expenses on a separate piece of paper or track them on the spreadsheet itself.

- Enter actual expenses for the month in column C. If you choose to do this at the end of the month, key in the total for each category in the correct column. If you want to track each expense as you spend it, put an = sign in the column and key in your amount. For each additional expense in that column, click F2, hit the + sign, and add your next amount. See below for an example

- One thing to consider when entering your actual expenses is to enter amounts from your checking/savings account and whatever you spend on your credit cards. That way, the total amount you spend – cash, check, debit, or credit – can be tracked against your budget.

- Once all your expenses are entered (from your checking account and credit cards), review your variances in column D.

- For expenses: If columns have a positive amount, you have a surplus in that column and are keeping expenses under budget. If Column D has a negative amount, you will need to reduce your spending or allocate your budget from categories where you have a surplus. For income: it’s the opposite. If actual amounts (column C) are higher, you have a surplus. Otherwise, your income didn’t meet your budget and you will need to adjust expense budgets/spending accordingly.

- For Net, column C Net (C28) will be what you have left over in your budget. If it is positive, you spent less than you budgeted. If it is negative, you spent more than you budgeted. If you didn’t budget your entire budget in column B, your net in column C will be that amount (B28) plus your variance in column D (D28).

Budgeting takes practice, consistency, and discipline to track what you earn and what you spend across various categories. It doesn’t have to be hard but it can help you save money, get out of debt, and keep your finances on track.

If you like this spreadsheet and want to use it for your budget, Email and I will send it to you. Good luck and happy finances!

Very straight forward directions to creating a budget spreadsheet! You broke it down nicely!

this post is very usefull thx!

We in our house follow one week Budgeting. This helps to maintain our spending’s at a certain level and if there’s any savings during the course (generally there is), that’s an added advantage.